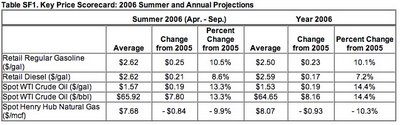

In it's brand-new Short-Term Energy and Summer Fuels Outlook (STEO), the US Energy Information Administration (EIA) predicts summer gasoline prices in the US will average $2.62 per gallon - 11% or $0.25 per gallon higher than last year’s summer average of $2.37 per gallon. The agency expects summer diesel prices of $2.62 per gallon as well.

In it's brand-new Short-Term Energy and Summer Fuels Outlook (STEO), the US Energy Information Administration (EIA) predicts summer gasoline prices in the US will average $2.62 per gallon - 11% or $0.25 per gallon higher than last year’s summer average of $2.37 per gallon. The agency expects summer diesel prices of $2.62 per gallon as well.

The agency also forecasts continued high crude oil prices through the rest of 2006, with a razor-thin buffer between consumption and production, Green Car Congress reports.

The EIA attributes the increase in gasoline prices to a number of factors:

EPA estimates that the Tier 2 gasoline sulfur program will cost less than 2 cents per gallon for the refining industry to produce low-sulfur gasoline when the program is fully phased in.

The decision to eliminate MTBE was driven by State bans due to water contamination concerns, continuing liability exposure from adding MTBE to gasoline, and perceived potential for increased liability exposure due to the elimination of the oxygen content requirement for reformulated gasoline (RFG) included in the Energy Policy Act of 2005.

Planning for new ethanol capacity that will be needed to provide ethanol to make RFG when MTBE is eliminated did not anticipate such a rapid exodus from MTBE blending.

The phase-out of MTBE is projected to increase slightly the average price of all gasoline. The price impact should be higher during the summer than winter because of the required reduction in gasoline vapor pressure during the summer months. Of greater concern with the MTBE phase-out is the increased potential for localized price spikes arising from unexpected supply disruptions.

Higher diesel fuel prices are also expected because of the additional cost of producing ultra-low-sulfur diesel fuel required later this year.

By September 2006, the EIA forecasts that fuel prices will drop below the soaring prices last year at that time resulting from the crude oil and natural gas production and refinery outages caused by Hurricanes Katrina and Rita in 2005.

The EIA is careful to note however that its projections do not factor in hurricanes and tropical storms with a potential to cause significant new outages. While the 2006 Hurrican Season is not expected to be as fierce as last year's record season, it is not expected to be a light season either and more large storms could make landfall in the Gulf Region this year.

The STEO had this to say as to the world supply of crude oil:

"But, in some ways 2006 is likely to bring an even tighter global petroleum market than 2005, if one sets aside the effects of the two hurricanes on US production last year.A buffer of 100,000 barrels per day in a 85.2-million bbl/d market is, for a ll practical purposes, no buffer at all. With that basically non-existent buffer, any shock to oil production anywhere in the world could shoot world oil prices up, making the market very volatile. The EIA forecasts that even that thin margin will disappear in 2007 as world consumption comes to match production almost perfectly. That should make for another very 'interesting' year. The EIA:

Consumption growth outpaces production growth in 2006 by 0.4 million barrels per day (bbl/d), compared to 0.1 million bbl/d greater consumption growth than production growth in 2005. Also, while the world experienced a global stock build in 2005 of 0.5 million bbl/d, a stock build of just 0.1 million bbl/d is expected in 2006.

...Nevertheless, in 2006 annual world consumption growth is forecast at 1.6 million bbl/d, compared with 1.1 million bbl/d in 2005. This will leave average total world consumption in 2006 (85.2 million barrels per day) about 100,000 bbl/d less than average world production."

World consumption growth is projected to increase further to 1.7 million bbl/d in 2007 because of economic growth in developing Asian countries. Chinese consumption growth is projected at about 0.5 million bbl/d per year. Overall, world petroleum demand is forecast to increase by 2.0 percent in 2007, compared to 1.8 percent in 2006. However, greater forecast non-OPEC production growth in 2007 will mean that average total world oil supply will equal average total world oil demand for 2007.In contrast to gasoline and diesel prices, the EIA projects natural gas prices will be down sharply during the late summer and fall compared to the hurricane disruption-related highs of 2005. However, the expected average for 2006 for Henry Hub spot prices of about $8 per thousand cubic feet (mcf) of gas, while down about $1 from the 2005 average, is still well above the pre-2005 historical maximum of about $6, reached in 2004, the EIA reports. The EIA's forecast for 2007 includes Henry Hub average prices moving closer to $8.40 per mcf, assuming normal weather and continued economic expansion in the United States.

Good times ... good times ...

Resources:

No comments:

Post a Comment